Managing an inherited IRA can be complicated. How should you take distributions from an inherited IRA? Do you need to take required minimum distributions (RMDs)?

The 2019 SECURE Act changed how inherited IRA assets were distributed. Specifically, it required beneficiaries who inherited from an IRA owner who passed away on or after January 1, 2020, to distribute all assets from the inherited IRA within 10 years.

(So-called eligible beneficiaries, which include the original account owner’s spouse, minors, disabled and chronically ill beneficiaries, as well as beneficiaries who were not more than 10 years younger than the deceased, were exempt from the 10-year distribution rule. These beneficiaries could still take distributions from an inherited IRA over their lifetime.)

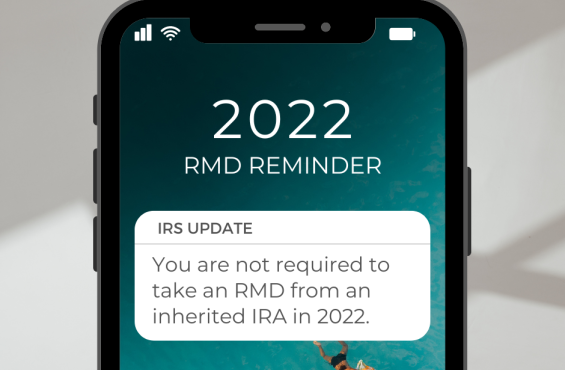

IRS update on RMDs from inherited IRAs

One question remained about inherited IRAs: What about required minimum distributions or RMDs? Were beneficiaries required to take RMDs from inherited IRAs during the 10-year distribution period, or could they choose to take a lump-sum distribution in the tenth year?

The IRS provided some clarification in October, issuing Notice 2022-53, which states that there are no RMDs required for 10-year beneficiaries, at least for 2021 and 2022. However, there is still the possibility that beneficiaries will need to take RMDs next year and beyond, so stay tuned. (The IRS intends to provide final regulations at a later date.)

While no one knows don’t know what the IRS will require in future years, the good news for non-eligible IRA beneficiaries is that there are no required distributions for last year and this year.

Why you might want to take a distribution from an inherited IRA in 2022

Even though you are not required to take a distribution from an inherited IRA in 2022, it could be beneficial to do so. Depending on your income level, spreading out distributions over the 10-year withdrawal period could result in smaller yearly distributions, which could be more tax efficient than waiting to take a lump-sum distribution at the end of the tenth year. Learn more about inherited IRA distribution strategies here, and talk to your wealth planner and CPA to determine what distribution approach is best for you.

If you’re not confident about what to do with an inherited IRA or you’re curious about how an adviser might help you manage inherited assets, click here to set up a time to talk with a FundX adviser.