Managing year-end mutual fund distributions is one way to try to reduce your investment taxes.

Remember that if you invest in a taxable account, you’ll pay taxes on any mutual fund distributions you receive, whether you take them in cash or reinvest them in new shares. Early indications show that some funds plan to make some big payouts in 2021, and even some ETFs expect to make capital gains distributions (this is unusual).

Here’s what you should know about 2021’s capital gains distributions with tips on what you should do this month if you own funds in a taxable account to make tax-smart investment decisions.

Find out:

- Funds that distribute in November

- 2021 mutual fund & ETF estimated distributions

- Biggest 2021 distributions so far

- Tips for investors who own funds in a taxable account

- What to do if your funds expect to distribute in 2021

- What if you own funds in a tax-deferred account

- How bond funds make distributions

Funds that distribute in November

Most funds make distributions in December, but some funds make capital gains distributions in November, including:

- Ariel (Nov. 18)

- Artisan (date differs per fund)

- a handful of Fidelity Select funds (date differs per fund)

- Leuthold (Nov.18)

- Parnassus (Nov. 18)

- Teton (Nov. 24)

Mutual fund estimated distributions

Most funds post preliminary capital gains distribution information on their websites, and many fund companies already have estimates available, including:

- American Beacon

- American Century

- AMG

- Dodge and Cox

- Fidelity

- Harbor

- Hennessy

- Hodges

- Janus Henderson

- Oakmark

- Royce

- T. Rowe Price (PDF)

- TCW (PDF)

- Vanguard

More estimates will become available this month, so keep checking to see if preliminary distribution information has been made available.

ETF estimated capital gain distributions

ETFs, particularly equity ETFs, rarely pay capital gains, but this year there are a few exceptions.

Nuveen ETFs plans to distribute capital gains. Nuveen ESG Mid-Cap Growth ETF (NUMG) has the highest expected distribution at roughly 12% distribution.

iShares ETFs also has provided estimated capital gain distributions for some ETFs. iShares Convertible Bond ETF (ICVT) is expected to pay out about 5-6%.

Vanguard also expected capital gains distributions from some of its ETFs, notably Vanguard International Dividend Appreciation (VIGI), which has a 5% estimated distribution about half of which is short-term capital gains.

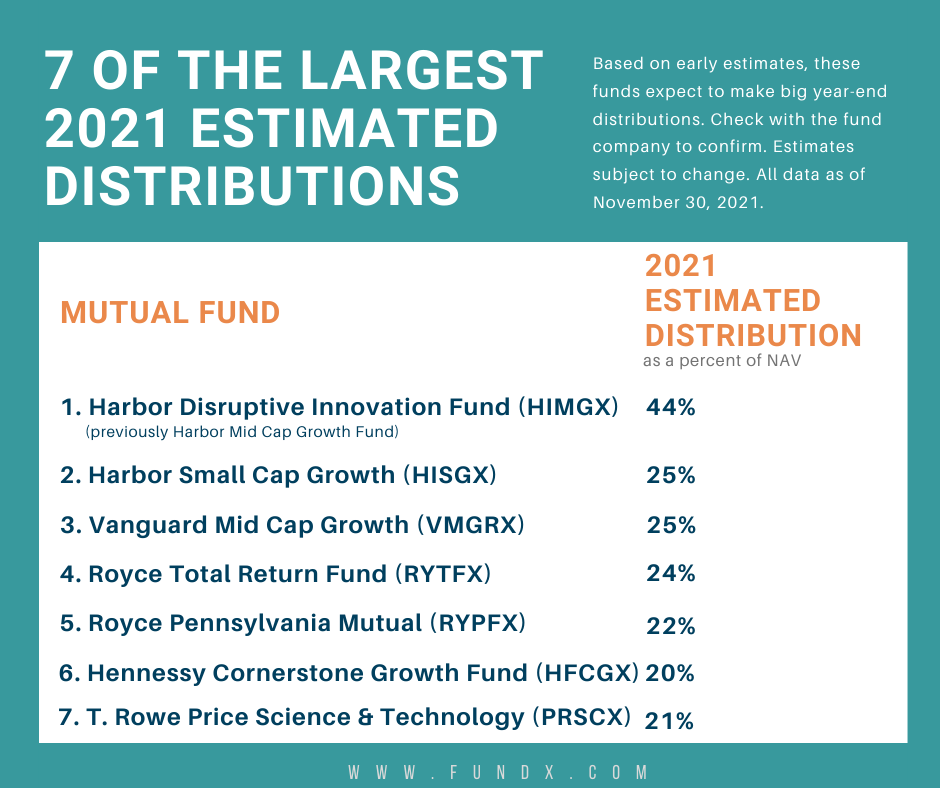

7 of the largest 2021 distributions so far (updated as of November 30, 2021)

Here are some of the biggest estimated distributions we’ve seen so far from the retail funds we track (keep in mind that not all funds had estimates available and that estimates can change over time, so you'll want to confirm this information directly with the fund company). There are also some sizable distributions from funds that are generally only open to investment advisors.

Tips for investors who own funds in a taxable account

You'll want to pay attention to your taxable accounts this time to year to avoid stepping into a potential tax liability. Here are some of the ways that FundX investment advisors do when managing taxable accounts for their wealth management clients.

1. Keep up with 2021 distribution estimates

Before investing in any fund this time of year in your taxable account, check to see if a fund expects to make a distribution this year before buying it.

You should also look to see if the funds you own expect to make distributions.

2. Trade carefully to avoid buying funds that expect to make big payouts

Use estimated distribution information to avoid buying funds that have big distributions planned. Remember that if you buy a fund right before it distributes capital gains, you’ll be paying taxes on gains the fund earned before you were a shareholder.

3. Consider ETFs

ETFs can be a good choice this time of year since ETFs seldom pay out capital gains, and ETFs typically distribute income quarterly. However, a few ETFs (Nuveen ETFs for instance) are expecting to pay unusual capital gains distributions this year; you’ll want to avoid buying these funds in a taxable account until after the distribution.

What to do if your funds expect to distribute in 2021

If a fund you own has a distribution planned, consider whether it is paying out short- or long-term capital gains. Long-term capital gains distributions are preferable because they’re taxed at a lower rate. (Remember that the tax status of a capital gain distribution is determined by how long the fund held the underlying security that was sold, not by how long you have owned the fund.)

Should you hold a fund and receive the distribution? Sell a fund before it makes a distribution? Or sell a fund after it distributes?

Deciding what to do about a distribution takes careful analysis. You’ll want to consider how long you’ve owned a fund, how much the fund is distributing, and how the distribution compares to your gains or loss on the fund. If you are holding a fund at a loss or at a gain that is much lower than the expected distribution, you’ll want to consider selling the fund prior to the distribution.

What if you own funds in a tax-deferred account?

You don’t need to worry about the tax implications of distributions if you own funds in a tax-deferred account, like an IRA or a 401(k), but you should still pay attention to distributions because a fund’s NAV or share price drops by the amount of the fund’s distribution, so it may look like a fund has sold off sharply when in fact, it’s simply made a distribution.

Learn more about what factors affect a fund’s distributions.

How bond funds make distributions

With bond funds, dividends accrue daily and are paid out to shareholders every month or quarter. Bond funds collect the income from the underlying bonds and keep it in a separate internal "bucket." A bond fund calculates a daily accrual rate for the shares outstanding, and shareholders only earn income for the days they actually hold the fund. If you buy a bond fund two days before the fund’s month-end distribution, you would only receive two days' worth of income that month.

Not all bond funds distribute income monthly or quarterly, however. Some funds (like the fixed income fund we manage) distribute income on an annual basis. In this case, the fund incorporates the income from the underlying bonds into the fund’s NAV, like a stock fund, and distributes it once a year to shareholders.

Want to work with an advisor who actively manages distributions and helps you make tax-smart investment decisions? Set up a time to talk with a FundX advisor.