US stocks shook off September losses and brought in above-average gains in the third quarter.

The tech-heavy Nasdaq 100 gained 12.5%, the S&P 500 was up 9.0%, and the Dow, 8.2%. Emerging markets also did well, up 10.3% for the quarter.

The stock market’s been remarkably resilient this year, and so have investors. But the presidential election poses a new challenge.

Nervous about investing before the election?

As we wrote in our take on investing in an election year, elections—and the constant media attention around presidential elections—can make you feel like you need to do something. But this feeling can lead to investment mistakes, like selling stocks when you really need to be invested or putting your investment decisions on hold until after the election.

Stocks have historically been positive in the fourth quarter, and in order to participate, you’ll need to be invested. So here’s a few ideas to help you stay on track this month and end the year on a strong note.

Get the facts about investing before an election

Start with our tips on investing in an election year, which includes resources from Fidelity, Invesco, Forbes among others, plus our tips on what to do with your investments before an election if you feel like you have to do something.

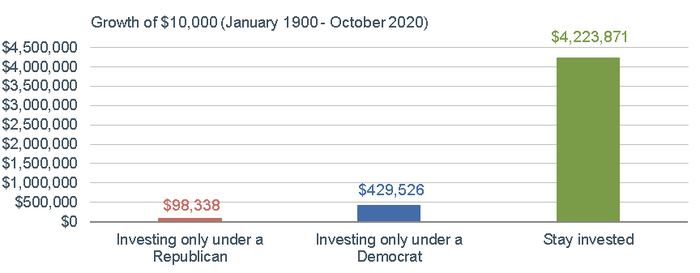

This Schwab chart is a good reminder that the best investment results come from staying invested in stocks long term, no matter who wins the election.

The chart shows the results of investing $10,000 in stocks, as measured by the Dow Jones Industrial Average.

Stocks have gained under both political parties, and, as Fortune pointed out, stocks have also fallen under every president since Herbert Hoover. Rather than trying to guess which political party might be better for stocks, focus your attention on which stocks can help you meet your long-term financial goals.

Review how you’re managing risk in case there’s a sell-off

You can’t control the market or the outcome of the election, but you can control how you’re invested and how you’re managing risk. If you’re worried about a stock market decline around the election, then this could be a good time to review how you or your financial advisor is working to mitigate risk in your portfolio.

- Do you have too much invested in one sector? Many market indexes and stock mutual funds have more exposure to technology these days. Morningstar found that “the average U.S. stock-fund allocation to the communication services and information technology sectors rose to 28.6% at the end of August 2020.”

Some market indexes are more concentrated than others. The S&P 500 has about 24% in technology, for instance, while the Nasdaq 100 has about 44%.

- Is your asset allocation still on target? Your allocation should help you participate in the market’s long-term gains and help you withstand short-term losses. In some of the accounts we manage for our wealth-management clients, we seek to offset some of their stock market risk with investments in bond or alternative funds, which are less correlated with stocks. What do you own that can help you buffer volatility through this election cycle?

Remember that stocks may fall in response to an unexpected change in the presidency, but historically that’s been short-lived and could provide a buying opportunity.

Be open to new opportunities

Many investors assume changing markets are a problem that should be avoided, but in our 50 years, we’ve learned that change often brings new opportunities, and our investment strategy seeks to help us capitalize on changing markets and invest in new leaders.

The last technology boom and bust in the early 2000s provides a real-world case study. When technology fell out of favor in 2000, some investors rode it all the way down. Our strategy led us to move into value funds, which had begun bringing in stronger returns. This helped us sidestep some of the losses from technology and capitalize on the new value trend.

If you’d like to work with an investment advisor who can help you navigate changing markets and stay on track in an ever-changing world, click here and let’s set up a time to talk.